Oilman Magazine Exclusive: Implementing the Right Strategies to Immediately Boost Operator Cash Flow

Peake, LLC CEO, Kevin Decker and W Energy Software VP of Field Operations Solutions, Steve Haglund, authored a featured article in the Oilman Magazine September 2020 digital publication. Titled ‘Implementing the Right Strategies to Immediately Boost Operator Cash Flow’, Decker and Haglund discuss a number of impactful strategies your team can implement today to drop more revenue into the bottom line. Read the full article below.

During these challenging times, with rigs drastically cut and completion crews on indefinite hold, finding ways to immediately impact cash flow is critical. If you are a C-Suite, division VP, or field leader, there are a number of impactful strategies your team can implement today to drop more revenue into the bottom line.

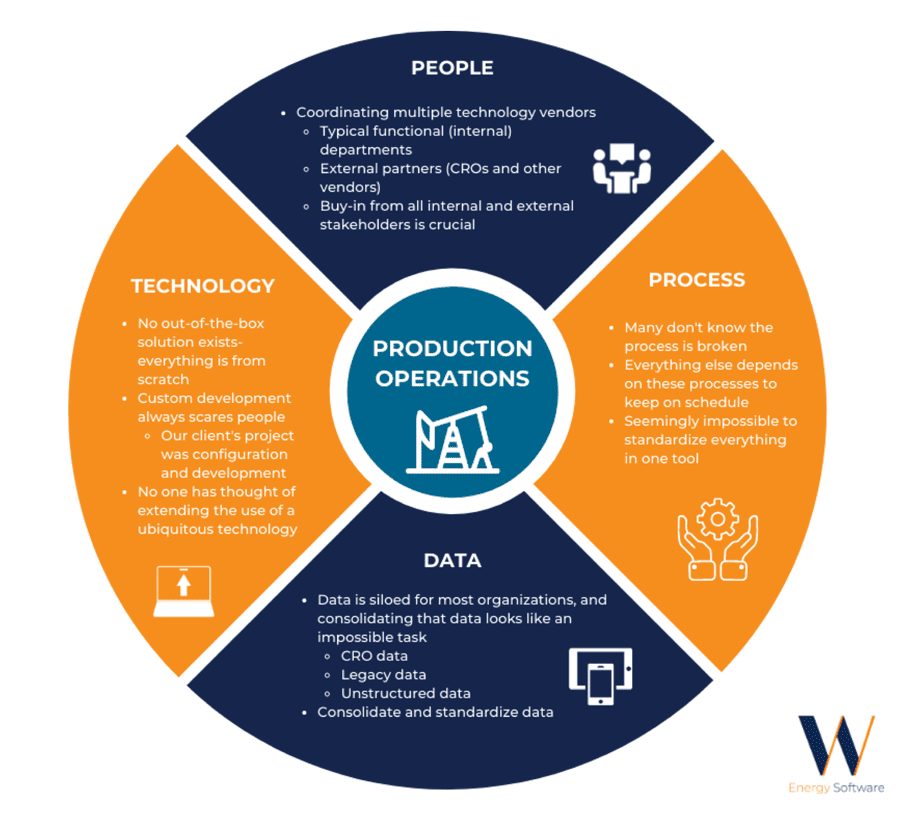

The strategies that will drive immediate cash flow results are pragmatic and entail aligning people, processes, technology, and data. This includes getting out in the field and starting a conversation with pumpers, building a production optimization process led by field production teams, leveraging production and non-op data, and empowering the back office with the right technology to boost cash flow.

People

- Pumpers, lease operators, and other field staff are often overlooked as an opportunity area.

- Take immediate action to visit and engage with field production teams.

- Acknowledge fractured leadership and create a clear channel of communication.

Process

- Field production teams have valuable insight into production optimization.

- Empower field staff to create short-term plans to improve their wells.

- Redirect capital from drilling and completions projects to field staff projects to increase cash flow.

Technology

- Production operations often rely on fragmented, legacy technologies.

- Cloud-based solutions enable collaboration among field and back office.

- A unified platform eliminates data silos, streamlines field operations and accounting.

Data

- Operated and non-operated data is key to uplifting margins and reducing costs.

- Create a data management culture to ensure data quality and availability.

- Leverage non-op data to improve revenue forecasts and accruals.

Bridging the Gap Between Executives and Field Staff

It’s ironic that after spending millions to drill and complete a well with much fanfare, operators often unceremoniously hand over the daily upkeep of a new well to field staff that is charged with maintaining it for its entire lifespan. And while drilling and completion teams are often rewarded with celebratory events when they reach certain targeted goals, production teams are often inadvertently ignored.

Don’t wait! Immediately set up a time to visit field production teams; both group sessions and a few one-on-one meetings will prove to be immensely helpful in the effort to increase cash flow. Don’t rush it. Senior leadership should devote plenty of time for these visits, as they could have the biggest impact the organization has on increasing base production all year.

For mission-critical field staff that has been unintentionally marginalized, it is important to create a dialogue, not a monologue or pep talk. Ask meaningful questions, then be sure to listen. Hear what they have to say and encourage them to open up and share their ideas around improving well performance and reducing downtime. Most field staff will have a plan for increasing the base production of their wells in multiple ways. They just need help with a few roadblocks, a budget, or simply encouragement to help get their ideas and plans into motion.

Acknowledge fractured leadership. Be transparent when talking to production teams. While drilling and completion departments often have one VP or senior leader over the entire division, production often suffers from “fractured leadership.” It can include production field leadership, divisional or business unit leadership, engineering leadership, reservoir leadership, and sometimes other teams with a vested interest in impacting field production. This often produces mixed messages to field production personnel, leading to conflicting or wasted efforts, projects, and time.

By getting out in the field and listening to field staff as well as acknowledging fractured production operations leadership, management teams can open up a clear channel for incorporating valuable field-level insights that can provide immediate payoff for production optimization and increased cash flow.

Building a Continuous Optimization Process Led from the Field

Leveraging new channels of communication with field production teams, the next step management teams can take to quickly boost cash flow is to create clearly aligned and unified processes to enhance base production backed by a small budget and investment of senior leadership time.

Due to fractured leadership, field production teams often receive multiple different plans, strategies, and initiatives. Rather than taking a top-down planning approach, start a grassroots initiative that enables field production staff to initiate their own plans for optimizing production for their well set. Listen to their ideas and align those insights across teams to begin building a broader plan guided by those closest to the wellhead. That plan can serve as the initial draft for foremen, optimization teams, engineers, and others to add their contributions.

Most pumpers, lease operators, automation, or measurement techs have untapped ideas about improving base production (wells they know will respond if someone will listen). Let those ideas help you design your short-term road map. That plan should be simple and cohesive with a laser focus on improving cash flow immediately, including:

- Artificial Lift – insights into optimal set points and equipment configuration for rod lift, ESPs, etc.

- Oil Stock Management – ideas around improving hauler efficiency and accelerating sales runs.

- Daily Process Optimization – reducing pumper admin burdens so they can focus on optimizing their wells.

- Operating by Exception (OBE) – giving explicit permission to prioritize wells with most down volume.

- Downtime Reduction – ideas around proactively preventing compressor/equipment failure and minimizing downtime when wells are offline.

- Technical Innovation – short-term technology ideas with big potential for increased volume and reduced risk/LOE.

Field production teams will often move heaven and earth to hit a goal set by their CEO, COO or VP. Set challenging but achievable goals in each of the areas above with a short-term end date, then measure the progress on at least a weekly basis. To succeed, senior leadership will need to invest a little of its time and energy as well as find ways to redirect capital to field production staff and their cash flow projects, such as investing portions of unused drilling and completion budgets.

Uplifting Margins with Operated and Non-Op Data

In addition to optimizing production, accurately booking reserves and accruing for inbound revenue (volume) and expenses are also key to uplift your margins. Operated and non-operated data holds the key to optimize both revenue and costs; however, organizations must first create the right data management culture.

Within every oil and gas company exists the vast potential to improve cash flow leveraging existing information about assets and production, yet it is all too often trapped in data silos or the data is simply underutilized. To unlock this revenue-generating potential, take the time to automate processes and empower the right resources with data management and QC tasks.

- Automate production workflows – Wherever possible, automate manual production tasks across your organization to free up time for those techs and staff to find, validate, and analyze your data. Don’t assume that it’s already been done, because often those tasked with automating workflows have job security concerns that interfere with that automation. Demonstrate that automation enables them to analyze versus input the data.

- Free up production engineers – Do a quick engineering process review and find out if your production engineers are doing true engineering, rather than preparing AFEs, county courthouse visits, endless slide decks for leadership, etc. If not, allow them to do what they love and give them the production data to do it. They will find the best opportunities if they have the time and the data.

- Find your data analysts – In every organization, there are several (although often quiet) data junkies that feed on data analysis projects. Get them engaged to find the best production cash flow projects across your operations. There are hundreds of them waiting to be discovered and analyzed but need someone with the time and focus to do research.

- Validate the data – Spend a little time empowering your IT, field operations, and production accounting teams to identify where opportunities exist to clean the data. Very often, over time, teams build data correction into their daily routine, rather than validating it at the source. Cash flow generating data analysis depends on the quality of your data and the simple yet effective processes that validate it and keep it clean.

- Remember your reservoir engineers – Every volume and process improvement that enhances the data makes your reservoir forecasts better, which means more accurate cash flow and financial projections. It pays to invest time and energy into automating and validating this data so it represents the clearest, most accurate picture available.

By engaging your teams (engineers, analysts, IT, and newly identified data analysts) your organization will be more prepared than ever to quickly compile a list of the best opportunities to immediately boost cash flow for minimal Capex/LOE.

Non-op data is one of the most overlooked assets that can boost or optimize cash flow, including reconciling revenue paid versus production volumes, improving reservoir production forecasts for non-operated wells, and improving revenue accruals for non-operated wells. Timely access to non-op data is also critical to identify risks associated with shut-ins or curtailed production. However, this vital data is often poorly circulated among partners with many operators prioritizing well data management for their operating assets over wells they only have a working interest in.

Exercise your rights to your non-op data by working directly with your partners to obtain the data you need or participate in free or low-cost reciprocal data sharing/trading networks to deliver non-op data right into your well database.

Empowering the Back Office with the Right Technology

As advanced in technology as the industry has become in areas such as drilling, completions, and geoscience, other aspects, such as business segment and enterprise-level resource planning software (ERP) on platforms designed 30+ years ago, are virtually antiquated yet still considered “Best in Class.” Think of what ERP covers in an oil and gas business and the implications are astonishing. Upstream companies pervasively rely on vintage technology to run their business, from production operations and allocations to their general ledgers and revenue disbursement. Adding to the overall lack of innovation is the industry’s addiction to spreadsheet allocations and workarounds in a Silicon Valley world.

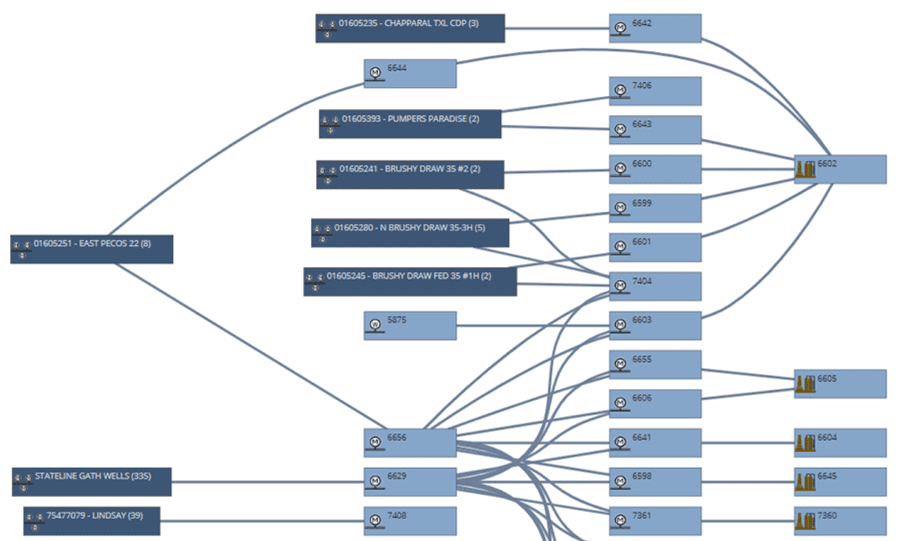

The choice of production operations technology is the key to building a clear channel of communication with field production teams, collaboration around production optimization processes, and creating a free flow of data in the organization. However, legacy technology, dozens of point solutions, and data silos impede the successful execution of these strategies and all too often inject delays, errors, and unnecessary costs for the organization. Maintaining complex allocation networks, for example, and calculating daily allocations are critical to operator revenue; however, cumbersome legacy software, manual processes, and spreadsheet-based solutions add significant time and uncertainty that often limit visibility into production and cash flow.

A unified production operations solution built on the Cloud offers scalability and affordability while accelerating data acquisition, processing, allocation, and financial reporting. As a result, operators can finally connect the field with the back office to gain the up-to-date view of production and revenue they need to manage cash flow.

Operators looking to benefit from the Cloud and an integrated software platform are increasingly turning to W Energy Software. The company pioneered the oil and gas industry’s only unified production operations solution built on the Cloud that features modern field data capture tools, production reporting, visualization of assets and allocation networks, and an extremely powerful and capable allocations engine. As a fully integrated upstream ERP platform, production accounting seamlessly flows into revenue and financial accounting where production volumes are linked with actual commodity pricing to provide operators with a precise view of their financials, field costs, and revenue.

Yet the most valuable benefits of a unified platform and W Energy Software are stability, predictability, and reliability. By eliminating the need to maintain the dozens of software applications and tools that operators have historically relied on and providing a common and consistent dataset, W Energy Software elevates confidence in your analysis, calculations, and financial results. When combined with increased performance, that trust can empower an operator’s workforce, reduce risk and accelerate business performance.

The oil and gas business is an industry slow to change field practices unless better alternatives are proven. Change is often difficult, especially with deeply ingrained field and back-office cultures, top-down management, fractured leadership, underutilized datasets, and legacy technology. But, with all of these challenges, there are still immediately actionable opportunities to make impactful change today. With a holistic strategy for creating a clear channel of communication with field production teams, driving grassroots insights, harnessing operated and non-op data, and deploying a unified production operations platform, operators can drive profound change across the organization that converges on maximizing revenue, reducing costs and improving cash flow.

Subscribe to Our Insights

Be the first to access blogs, case studies, videos, and more from our experts.